In 1897 while traveling London, an article came out that Mark Twain had died. When asked by a reporter about this and his health, Twain replied, “Reports of my death have been greatly exaggerated.” So why this quote for a blog on and about real estate? Ahh.., because reports of the death of a seller’s market have been greatly exaggerated. Make no mistake, we are still in a seller’s market. Allow me to explain.

In 1897 while traveling London, an article came out that Mark Twain had died. When asked by a reporter about this and his health, Twain replied, “Reports of my death have been greatly exaggerated.” So why this quote for a blog on and about real estate? Ahh.., because reports of the death of a seller’s market have been greatly exaggerated. Make no mistake, we are still in a seller’s market. Allow me to explain.

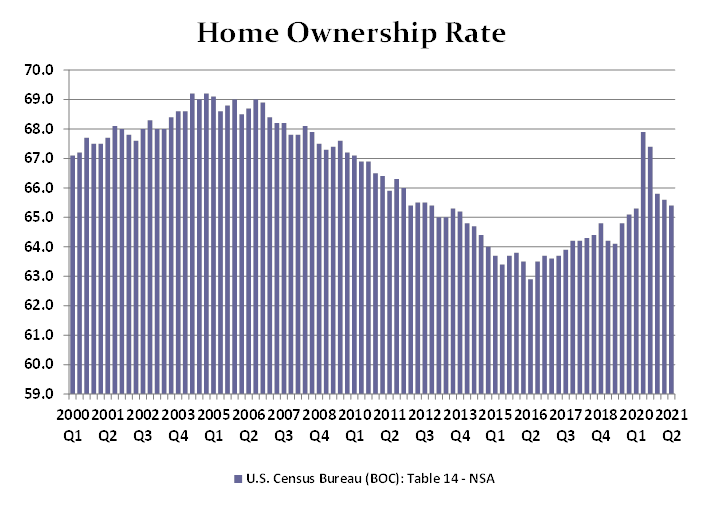

When the Fed began tightening interest rates to reverse inflation, the real estate market took a quick kick to the head. When rates reached 6% in early summer, the market began to slow down dramatically as affordability took a hit. But as summer has continued a few things have happened that have caused the market to regain some footing. Rates for example, dropped as the prospect of a recession grew in the minds of Wall Street traders. Why did they think this was going to happen? Simply put the yield curve inverted. This is a term used when the shorter-term bond is offering a better return than the longer term. “2’s and 10’s” they like to say. The yield on the 2-year treasury was higher than the 10-year treasury. [Find us on social media here] Normally the shorter term pays less (think of a short term vs. long term CD at your bank). Thus, when the shorter pays more, historically this is an indication we are heading into recession. I’m not going to explain the relationship of yield and price, except to say investors bought up the long-term bonds rather than short term and that caused the rate on the long bond to drop. Another key recession indicator is that we had two successive months of negative GDP. This is the technical definition of a recession. So, in technical terms we already are in a recession. Naturally extrapolated out you’d have to conclude housing is going to fall.

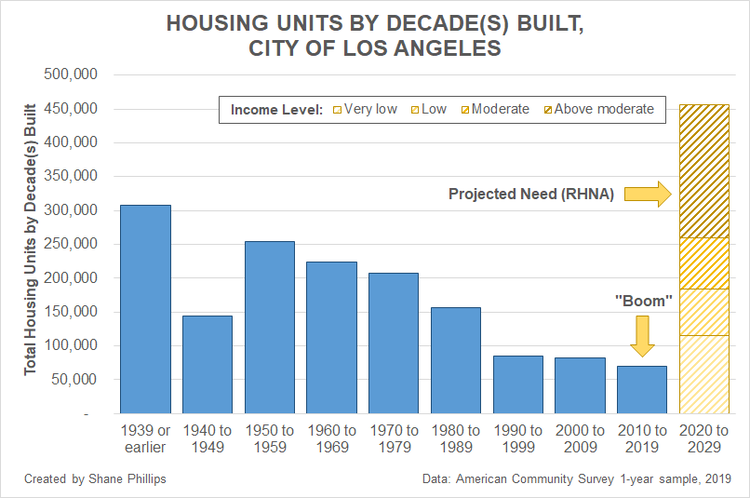

It’s a funny thing about memory. Whatever has just happened is what we think will happen again. For some in real estate, it’s the myopic thinking that the market will continue to rise without any slowdown or correction because we just experienced two years of this kind of market and that’s what they have in recent memory. For many it’s the belief that a correction is going to be like 2008-2012. We aren’t just going to have a mild correction, no, we are going into The Great Recession Redux. This is because this is what we remember. And people always are saying, history repeats itself. Naturally therefore, we should expect a massive crash in real estate values [Check what your home is worth here]. Before I go any further, let me just say, this is not going to happen. Why? People can afford their mortgages for one. People have equity so the market won’t be flooded with distressed sellers just walking away and giving their home to the bank, instead if they must sell, they will – for a profit. Demand is still massively higher than the supply of housing. Millennials are still in the early stages of household formation. Investors are dying for a redo of the 2009 market. All the investors I know (and huge Wall Street hedge funds I don’t) are chomping at the bit to see prices drop substantively. Why? The number of homes that should have been built during the Great Recession are still not built. We are so far behind that we may never catch up! That’s why. There’s not enough housing and investors want to own it. Have you seen rents lately. My gosh, I put up a 500 SF ADU in the San Fernando Valley for lease and had 30 inquires in 24 hours. And the asking rent is $2,050 a month! That’s nuts. And yet, here we are.

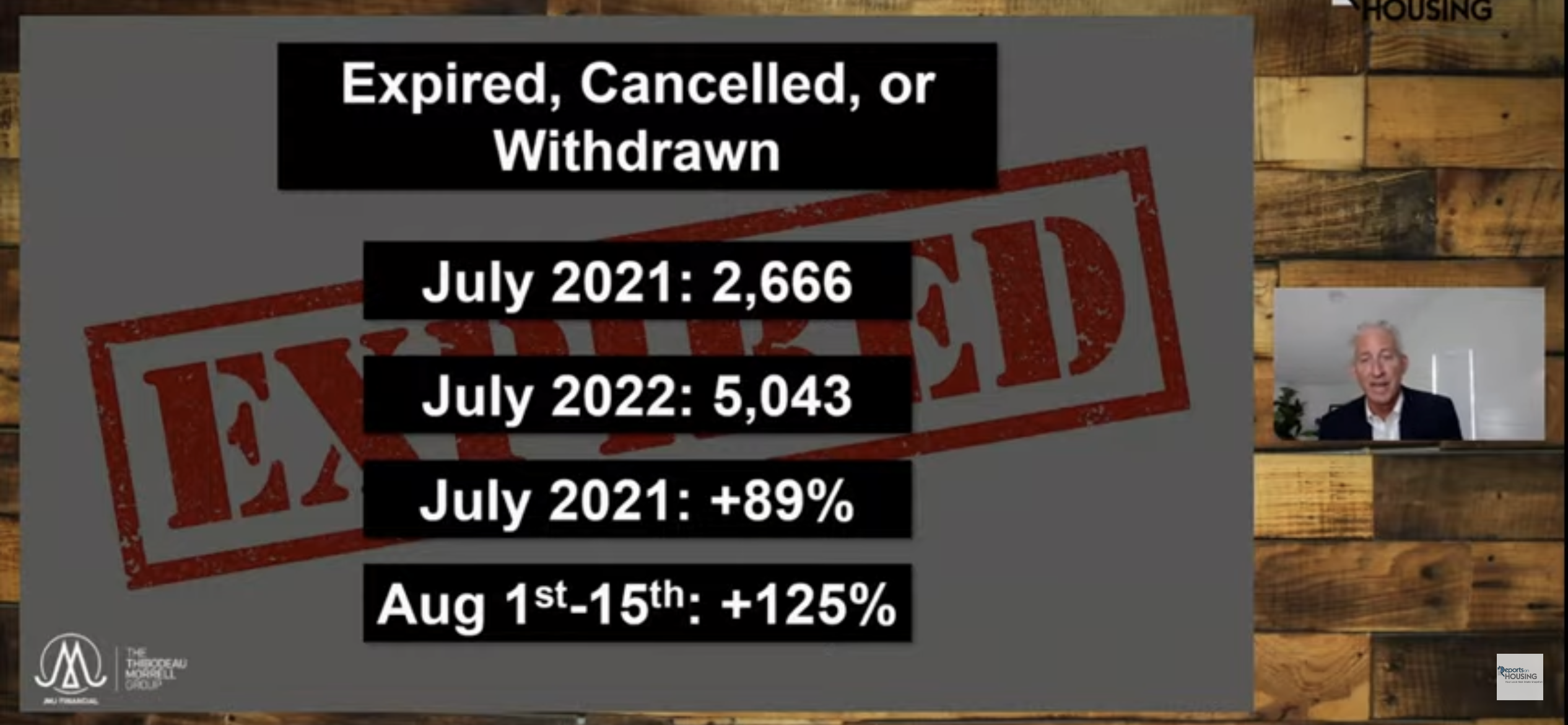

I follow a guy named Steve Thomas (follow Steve on his www.ReportOnHousing.com website here). According to the numbers, Steve says inventory peaked in June.  He goes on to say that amongst the many reasons that this has happened is that expired or cancelled listings are up 89% year over year!

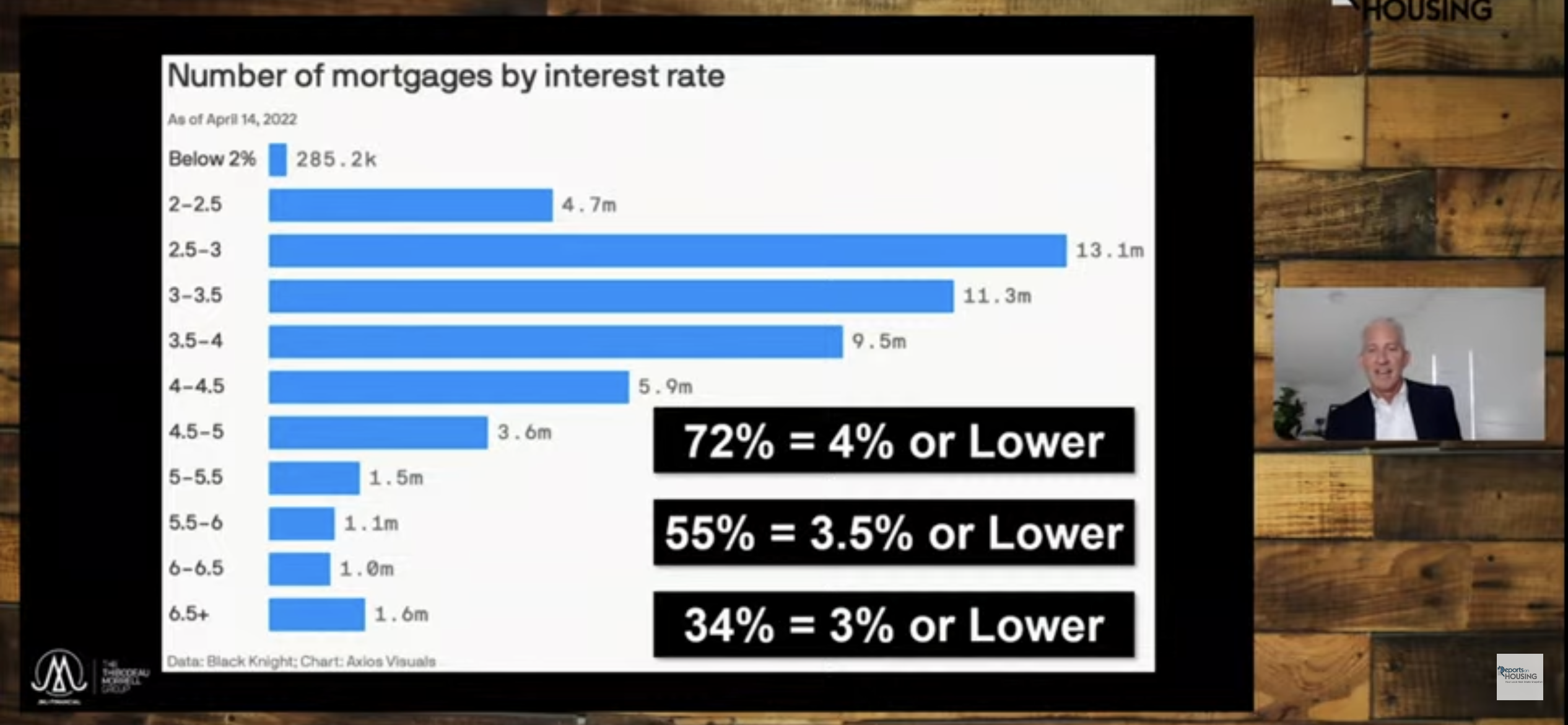

He goes on to say that amongst the many reasons that this has happened is that expired or cancelled listings are up 89% year over year!  He says that with 72% of all active mortgages below 4%, that sellers are simply electing to stay put rather than fight the current of an adjusting market.

He says that with 72% of all active mortgages below 4%, that sellers are simply electing to stay put rather than fight the current of an adjusting market.  Locally we see that the pending sales are down 15% and the number of homes for sale is up 15%. It’s the same 15%. This tight supply even in the absence of record high demand, is still woefully insufficient to cause the value of real estate to epically decline. Yes, we are seeing price cuts but this market behavior is consistent with a normal market. Historically prices rise in the spring and give some back in the fall. This is normal seasonal behavior. So, sellers who can no longer get what their neighbor got in the spring market, are having to reduce their price. There’s nothing unusual about that. Moreover, during the early part of 2022 inventory was at all time lows. In our local Conejo Valley, that number actually went below 100 homes for sale. In that environment, anyone with 4 walls and a kitchen could sell regardless of condition or location. This is no longer the case. Homes with warts or in locations that aren’t desirable or are in disrepair, are no longer selling at the sky-high prices. So here is a point of difference that’s not seasonal and strictly a situation being driven by the shift in interest rates, buyers’ affordability, and the fact that a slower market means more inventory [Contact Tim here]. More inventory means more choices and a buyer can be a little more selective. Imperfect homes must now be priced in a way that reflects this. This is normal market behavior. The frenzy is largely over but great properties are still receiving multiple offers. Good properties are selling but at a slower pace. All this means one thing: It’s still a seller’s market – just not as strong as it was. So yes, the reports of the death of the housing market, have been largely exaggerated.

Locally we see that the pending sales are down 15% and the number of homes for sale is up 15%. It’s the same 15%. This tight supply even in the absence of record high demand, is still woefully insufficient to cause the value of real estate to epically decline. Yes, we are seeing price cuts but this market behavior is consistent with a normal market. Historically prices rise in the spring and give some back in the fall. This is normal seasonal behavior. So, sellers who can no longer get what their neighbor got in the spring market, are having to reduce their price. There’s nothing unusual about that. Moreover, during the early part of 2022 inventory was at all time lows. In our local Conejo Valley, that number actually went below 100 homes for sale. In that environment, anyone with 4 walls and a kitchen could sell regardless of condition or location. This is no longer the case. Homes with warts or in locations that aren’t desirable or are in disrepair, are no longer selling at the sky-high prices. So here is a point of difference that’s not seasonal and strictly a situation being driven by the shift in interest rates, buyers’ affordability, and the fact that a slower market means more inventory [Contact Tim here]. More inventory means more choices and a buyer can be a little more selective. Imperfect homes must now be priced in a way that reflects this. This is normal market behavior. The frenzy is largely over but great properties are still receiving multiple offers. Good properties are selling but at a slower pace. All this means one thing: It’s still a seller’s market – just not as strong as it was. So yes, the reports of the death of the housing market, have been largely exaggerated.

provided you “Buy it right.” By this I mean, an appropriate discount from market price because when you go to sell, you have to discount it in the same way. What made our recent market unique was that the shortage of properties compelled some buyers to pay market for a challenged property and not buy with the appropriate discount. In a market like the one we were just in, everything sells. But in a normal market, that’s not how it works. And in a down market, that’s definitely not what happens. In a down market, there’s always a nicer home or better location that must sell at the same time and the discount you have to make often times ends up disproportionate. A home is only worth what a buyer will pay and if they can buy a better property than yours for “X” then you have to offer a discount to incentivize the buyer to buy yours.

provided you “Buy it right.” By this I mean, an appropriate discount from market price because when you go to sell, you have to discount it in the same way. What made our recent market unique was that the shortage of properties compelled some buyers to pay market for a challenged property and not buy with the appropriate discount. In a market like the one we were just in, everything sells. But in a normal market, that’s not how it works. And in a down market, that’s definitely not what happens. In a down market, there’s always a nicer home or better location that must sell at the same time and the discount you have to make often times ends up disproportionate. A home is only worth what a buyer will pay and if they can buy a better property than yours for “X” then you have to offer a discount to incentivize the buyer to buy yours.

the rarest of rare. This would be a view lot (rarest of all amenities), a large lot and a cul-de-sac lot [

the rarest of rare. This would be a view lot (rarest of all amenities), a large lot and a cul-de-sac lot [

into a recession in 2023.” What is this @Anchorman? They sound like Paul Rudd’s character Brian Fantana when he says of his panther cologne, “60% of the time, it works every time?” Seriously? If the economy is really in trouble prove it! And if there’s trouble on the horizon, how is it that continuing claims for unemployment (insurance) are at a level not seen since 1970 and still declining? That’s right, not going up, not leveling but still declining. We would realistically need to have 3 months with an average increase in unemployment of 3% or more, to indicate a recession is coming. There is no evidence of that.

into a recession in 2023.” What is this @Anchorman? They sound like Paul Rudd’s character Brian Fantana when he says of his panther cologne, “60% of the time, it works every time?” Seriously? If the economy is really in trouble prove it! And if there’s trouble on the horizon, how is it that continuing claims for unemployment (insurance) are at a level not seen since 1970 and still declining? That’s right, not going up, not leveling but still declining. We would realistically need to have 3 months with an average increase in unemployment of 3% or more, to indicate a recession is coming. There is no evidence of that. even if prices drop. “Why, you ask?” Why would you? Even if you’re financially under stress, you can always get a renter if you had to. And of course, if past experience portends to the future success, prices will eventually go back up (

even if prices drop. “Why, you ask?” Why would you? Even if you’re financially under stress, you can always get a renter if you had to. And of course, if past experience portends to the future success, prices will eventually go back up ( guidance when it comes to matters involving real estate. Rising rates are not the end of the world. Rising rates are the result of rising inflation and inflation raises all asset classes including real estate. This notion that rising rates is the death knell of real estate is simply as my mother would say, hogwash. But there’s no doubt that rising rates do and should alter they way we view a real estate purchase.

guidance when it comes to matters involving real estate. Rising rates are not the end of the world. Rising rates are the result of rising inflation and inflation raises all asset classes including real estate. This notion that rising rates is the death knell of real estate is simply as my mother would say, hogwash. But there’s no doubt that rising rates do and should alter they way we view a real estate purchase.

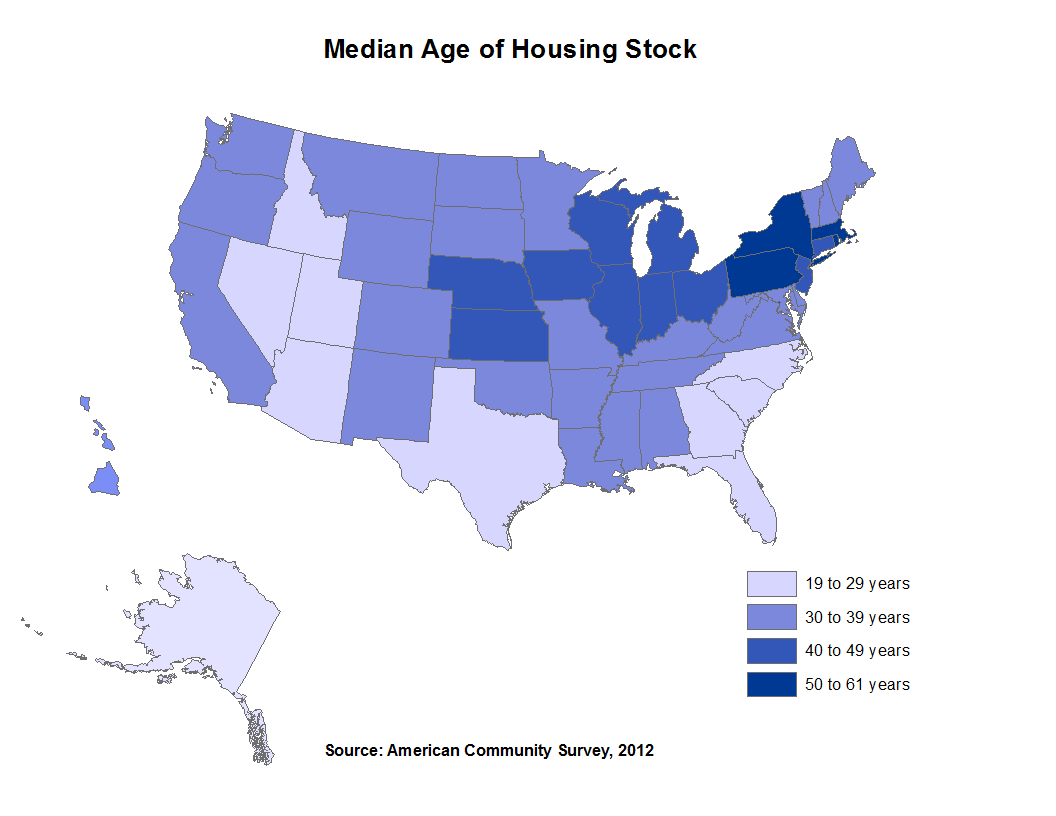

suspense. Alas, there is no suspense when it comes to housing. No, there’s no mystery here at all; we simply don’t have enough housing. And notice that I am carefully using the word housing, not homes. This is to emphasize that we have a structural problem, not just a problem of wealth inequality or a battle of the haves and have nots. We have not built enough shelter for our people and California is the worst, ranking at 49th in unit per resident ratio.

suspense. Alas, there is no suspense when it comes to housing. No, there’s no mystery here at all; we simply don’t have enough housing. And notice that I am carefully using the word housing, not homes. This is to emphasize that we have a structural problem, not just a problem of wealth inequality or a battle of the haves and have nots. We have not built enough shelter for our people and California is the worst, ranking at 49th in unit per resident ratio. comes to mind) and Small (Mom and Pops). Investors represented 17% of all buyers last month, squeezing out the would-be Millennials [

comes to mind) and Small (Mom and Pops). Investors represented 17% of all buyers last month, squeezing out the would-be Millennials [

was built on great story telling and imagination, the same fundamentals of film making today [

was built on great story telling and imagination, the same fundamentals of film making today [ price collapse [

price collapse [